The region demonstrates significant strengths across innovation, connectivity and industrial capabilitiy, with an extensive range of assets including:

The Local Growth Plan

The Local Growth plan (LGP) is a 10-year plan sets out the vision for the North East so it is known as the home of real opportunity and a region where everyone thrives.

Within 10 years we will have made substantive progress against our five key missions:

- Home to a growing and vibrant economy for all

- Home of the green energy revolution

- A welcoming home to global trade

- Home of real opportunity

- A North East we are proud to call home

This evidence base

This evidence base brings together regional insight to strengthen the Local Growth Plan providing a clear and accessible picture of our economy, communities, and growth potential.

These pages highlight the challenges we must address and the opportunities we can seize to deliver real benefits for people and businesses in the North East. This evidence base will guide investment priorities and shape policy. The evidence is split into the following sections:

- Our economy

- Our people

- Place

You can explore these sections below.

Context and overview

2nd

largest MCA by area and covers a diverse geography

2m

residents

55,340

businesses, who provide 820,000 jobs

4

univerisities, 9 FE colleges

and other examplar skills provision

3

deep-water ports, and an international airport

and riverside assets

Strategic transport connections

including the East Coast mainline; trunks roads including A1, A19 and A69; and Tyne and Wear Metro

Strong representation from catapult network

including Offshore Renewable Energy, Digital Catapult NE&TV, NE Satelitte Applications Centre of Excellence and High Value Manufacturing Catapult

A large, advanced manufacturing sector

with strengths in automotive, centred around Nissan, and rail, centred around Hitachi with many other great manufacturings in the region

Increasingly important low carbon sector

including offshore wind technologies, electrification, onshore wind and geothermal energy

A thriving tech sector

including Sage, Atom Bank, Accenture's european advanced digital technology centre, Open AI and Hyperscale QTS centre and growing opportunities around screen industries

Population

As of mid-2024, the North East’s population was about two million residents. Country Durham accounted for 26% of this total, followed by Northumberland and Newcastle each contributing around16%. The largest age groups are 19 – 21, reflecting a high student population, and 58 – 62.

The region saw population growth of 86,000 in the five years to 2024, slightly outpacing the national rate (4.4% compared to England’s 4.3%). Historically, the population had decreased by more than 79,000 in the two decades from 1981 onwards. It only returned to its 1981 level in 2021.

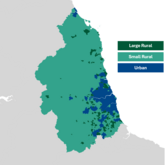

Geography

90%

of North East area is rural

Higher than England excl. London (84%)

85% made up of smaller rural settlements

Higher than England excl. London (79%)

97%

of Northumberland area is rural

89% of County Durham

51% of Gateshead

17% of Newcastle

9% of Sunderland

64%

of N.E. area far from major town/city

> 30 minute drive away

Higher than England excl. London (44%)

77% in Northumberland

48% in County Durham

28%

of N.E. area classified as remote

> 30 minute drive from any urban area

Higher than England excl. London (6%)

36% in Northumberland

16% in County Durham

The North East Combined Authority spans a diverse geography; from Berwick-upon-Tweed in the Scottish Borders to Barnard Castle in the Pennine Foothills. It includes National Parks, rugged coastlines, river valleys, vibrant cities, historic towns, and agricultural communities.

The 2021 Rural-Urban Classification (RUC), helps us understand more about the rural/urban geography, published in March 2025 using 2021 Census data, it categorises each Census Output Area (OA) based on settlement characteristics:

- Larger rural: Majority live in ABUAs with fewer than 10,000 residents, including small towns and low-density fringes

- Smaller rural: Dominated by villages, hamlets, and isolated dwellings

- Urban: Majority live in built-up areas (ABUAs) with 10,000+ residents

Map contains data from the Office for National Statistics licensed under the Open Government License v.3.0

Explore the Local Growth Plan

Section 1: Introduction and context

📍 You are here

This section offers an overview of our local assets, population and geography.

Section 2: Our economy

The economy brings together data on regional productivity, GDP, our key sectors and investment.

Section 3: Our people

Our people covers evidence on the skills of our residents, the labour market, deprivation and quality of life.

Section 4: Place

Place includes insight on the region's housing, climate, transport and tourism.