Real gross domestic product (GDP) per head shows a steady incline from 2009 followed by noticeable dip around 2020–2021, coinciding with the economic disruption caused by the COVID-19 pandemic. This is followed by a gradual recovery, indicating a rebound in economic output per person. The North East and England follow the same pattern.

Pay and productivity

Gross Disposable Household Income

Gross Disposable Household Income (GDHI) is the amount of money households have left to spend or save after essential outgoings. GDHI in the UK grew by 9.5% in 2023 when compared with 2022; GDHI in England grew by 9.6%.

Lowest GDHI in the UK

Of the countries and regions classified as International Territorial Level (ITL) 1, London had the highest GDHI per head in 2023 where, on average, each person had £35,361 available to spend or save; the North East had the lowest at £19,977, compared with a UK average of £24,836.

£36pp

Growth value added

Growth value added per hour worked stands at £36 per person in the North East, going up £13.30 from 2004.

North East growth value added per hour worked

Gross disposable household income by regions, 2023

Gross Domestic Product

Business base

Business births and deaths

In 2024, the North East region recorded 6,580 business births and 5,765 business deaths

+ 10,000

Business numbers in the North East

At the start of 2024, business numbers in the North East increased by 10,000 (6%) over the prior year.

Private sector

Over the period 2023–2024, the total number of private sector businesses in the North East rose (net) by 10,000, despite decreases in business numbers nationally in many regions.

The North East has a relatively low number of businesses per head compared to other regions of the UK, largely due to the impact of a lower rates of business births. While the share of high-growth firms is in line with national averages, access to finance remains a constraint.

Small to medium sized enterprises (SMEs) are central to the economy, representing 99.9% of businesses, 67% of employment, and 60% of turnover, with a higher share of private sector jobs in SMEs than in large firms.

Sector Overview

In the North east, over 16% of the workforce are employed in the broad health and care sector. Other high employment sectors in the region include education, manufacturing, retail and hospitality. More than half of employees in retail, hospitality and arts work part-time.

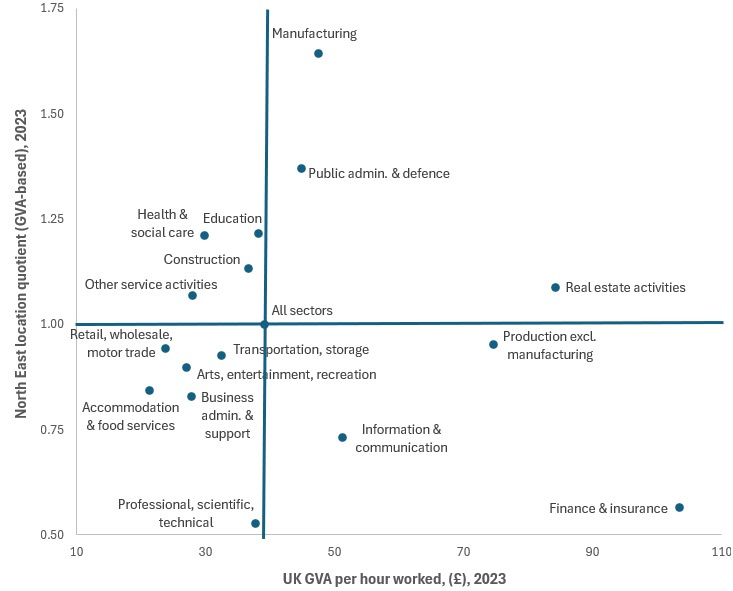

Location quotients reveal manufacturing and public administration as the most regionally significant sectors, both ranking high for productivity. In contrast, sectors with the highest productivity, finance, real estate and non-manufacturing production are less prominent locally.

Key sectors

Sectors where the North East has economic strengths, assets and opportunities were identified.

Offshore wind and energy transition

Current state: Around 1,000 renewable energy companies have North East sites, with an estimated 25,000 staff.

Comparative advantage: 9% of the UK’s offshore wind businesses are located in the North East.

Recent / projected growth: Aim to grow the regional offshore wind workforce to 24,000 by 2035.

Advanced manufacturing including electric vehicles

Current state: 3,900 businesses in advanced manufacturing employing 67,000 people.

Comparative advantage: 44% of England’s employment in battery and accumulator manufacturing.

Recent / projected growth: Employment in battery and accumulator technology has more than doubled since 2015.

Creative industries and content

Current state: 50,000 jobs in the wider region’s creative industries.

Comparative advantage: Outside of South East England, 6.3% of jobs in screen sectors and 6.6% of music/visual arts.

Recent / projected growth: 67% jobs growth in the wider region’s creative industries in past decade. This is the fastest growing sector in the region in the last 10 years in the UK.

Life sciences, pharmaceuticals and process industries

Current state: 8,000 employed in life sciences in the North East CA area.

Comparative advantage: Over 10% of England’s employment in pharma manufacturing – about 3,800.

Recent / projected growth: Value of pharma exports 2.4 times higher than a decade ago.

Tech, digital and AI

Current state: About 45,000 jobs in the wider region’s digital sector, with 8,400 employees in broad AI sectors.

Comparative advantage: 8.4% of UK employment in computer manufacturing outside the South East.

Recent / projected growth: 37% digital jobs growth in past decade; advanced digital skills are critical to all sectors.

Defence, security and space

Current state: One of the fast-growing space clusters.

Comparative advantage: One of the largest and longestestablished defence clusters, with links to space and digital.

Recent / projected growth: UK defence sector expected to grow by 50% over next five years.

Sectoral employment patterns

This set of maps illustrates how employment in key sectors is distributed across the region, highlighting both areas of concentration and wider patterns of economic activity. There is a clear urban dominance for creative, financial and professional services, which advanced manufacturing demonstrates a more region-wide footprint. Digital technologies, through concentrated, shows potential for growth beyond the urban core.

Employee numbers are mapped for selected growth-driving (IS-8) sectors, as defined in the UK's Modern Industrial Strategy 2025. The definition is based on an aggregation of subsectors in the UK's official Standard Industrial Classification (SIC), last updated in 2007.

R&D and innovation

The North East has one of the lowest overall R&D spend as a percentage of GDP in 2023, with a combined share below 2% of GDP. Business enterprise R&D forms the largest component, but it is modest compared to regions like East of England or South East. However, the North East stands out for its strong Higher Education R&D contribution at 0.85% of GDP, the highest among all regions, surpassing Yorkshire and the Humber at 0.69%. This indicates that universities and research institutions play a critical role in the region’s innovation activity, even though private sector and government investment remain limited.

Inward investment and trade

2,100

North East foreign direct investment (FDI) new jobs

3Y annual average: 3,100,

rate per head 60% above

England excl. London

rate in 2024/25.

7.0%

of English FDI new jobs outside London

were in the North East

in 2024/25.

44% of English FDI new jobs

were in London.

4.9%

of North East businesses exported goods

2023 (% of non-financial

private sector businesses).

Joint highest among the

nine English ITL1 regions.

4.9%

of North East businesses exported services

2023, lowest among the

nine English ITL1 regions.

8.9% exported goods

and/or services.

Economic market foresight analysis

In 2021, a regional economic markets foresight study was undertaken to provide an independent and objective assessment of the opportunities arising from new and emergent markets. This resulted in 16 market profiles which set out the global position, regional opportunity and interaction with wider global trends such as the green economy and an ageing population.

More of the Local Growth Plan Evidence Base

Introduction and context

This section offers an overview of our local assets, population and geography.

Our economy

📍 You are here

The economy brings together data on regional productivity, GDP, our key sectors and investment.

Our people

Our people covers evidence on the skills of our residents, the labour market, deprivation and quality of life.

Place

Place includes insight on the region's housing, climate, transport and tourism.