About this investment theme

The focus for this investment theme is to:

- Create jobs and boost community cohesion, through investments that build on existing industries and institutions, and range from support for starting businesses to visible improvements to local retail, hospitality, and leisure sector facilities.

- Promote networking and collaboration through interventions that bring together businesses and partners within and across sectors to share knowledge, expertise and resources, and stimulate innovation and growth.

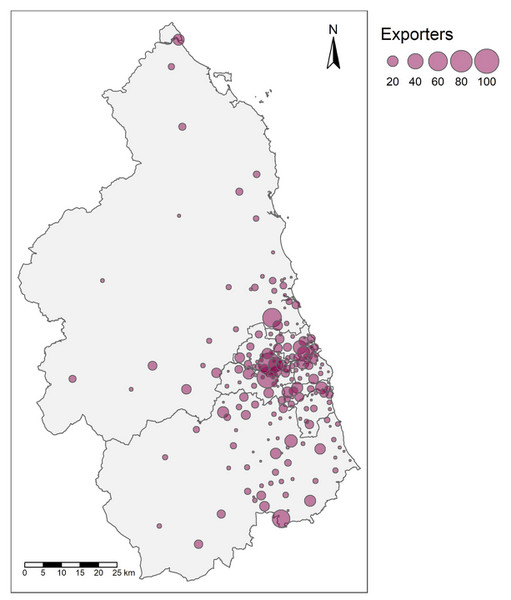

- Increase private sector investment in growth-enhancing activities, through targeted support for small and medium-sized businesses to undertake new-to-firm innovation, adopt productivity-enhancing (energy efficient and low carbon) technologies, and start or grow their exports.