Key sites include:

Leading offshore energy support base in Port of Blyth, along with other UK East Coast centres in Teesside (GE) and Humber (Siemens)

7 EZ sites around North Bank of the Tyne, and Port of Blyth

7km of quay next to deep water

400ha of key riverside development

Northern Powergrid electricity distribution network

Gas infras – Northern Gas Networks

District energy schemes including; the Freeman Hospital, North Tyneside General Hospital, The Royal Victoria Infirmary, Sunderland Royal Hospital, Riverside Dene high-rise Newcastle, The Rise new build housing scheme Newcastle, Newcastle University, the Gateshead Energy Centre. Studies undertaken by the Association of Decentralised Energy (ADE) estimate that the North East is home to around 9% of UK heat networks. However, adjusted for economic activity (heat capacity per £m GVA), the North East is second only to the North West and London.

Across the North East a significant number of new heat network feasibility studies have been undertaken. The results show huge potential for new schemes to be deployed, as well as for extension of existing schemes. This feasibility work has largely been led by local authorities, with many studies capitalising on BEIS funding via the Heat Network Delivery Unit (HNDU). This aggregated pipeline of schemes, across both the North East LEP and Tees Valley Combined Authority areas, comprises 23 potential schemes with a total estimated value of over £280 million. Schemes vary in terms of progress, between pre-feasibility and planned network extensions.

Mine energy and geothermal heat: The North East has a particularly rich geothermal potential, with both deep and shallow resources. This includes radiothermal granites in the North Pennines, and flooded mineshafts in abandoned coalfields particularly in Durham and Northumberland. Mine energy heat schemes have also already been deployed in the North East, with two existing projects; at Lanchester Wines and Dawdon Colliery. Wider geothermal schemes have also been explored to various stages, including the Eastgate Borehole. This research well was the first deep geothermal exploration to be drilled in the UK for over 20 years when it was drilled in 2004.

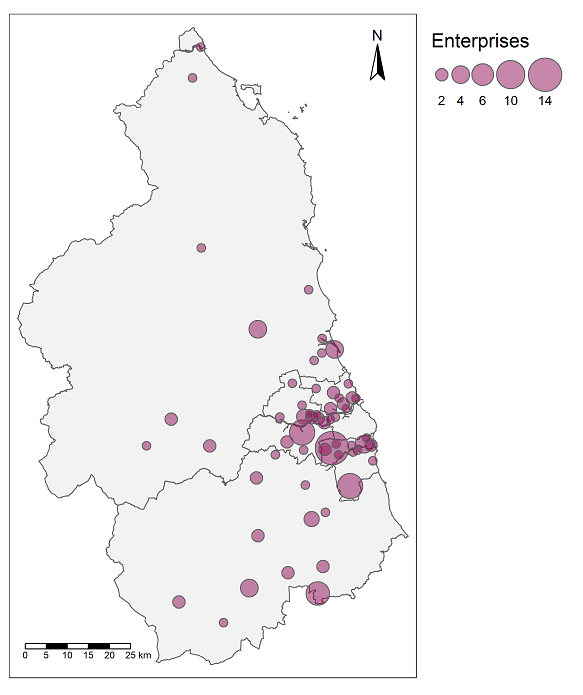

Large-scale renewables: The North East has a track record of delivering renewable energy capacity, capitalising on available natural resources, supportive planning regimes, and local supply chain capacity and skills. A number of Local Authority areas within the region are in the top 50 for renewable energy, across 406 UK authorities. Most notably, Northumberland generates the most renewable electricity from hydro, and second most from onshore wind, of any English Local Authority area. County Durham is also in the top six English Local Authority areas for onshore wind generation. The North East generates a significantly greater proportion of renewable electricity from onshore wind than the UK average.

Demand-side response (DSR) schemes: incentivise users to change the profile of their consumption, and energy storage technologies which allow surplus energy to be stored and sold when its needed. Organisations in the North East are already exploring these emerging solutions, for example several utility-scale energy storage and demand side response schemes are in place, including: A 25MW lithium-ion battery close to the Cobalt Business Park, North Tyneside, developed by Element Power and since acquired by Enel; A 35MW battery at Port of Tyne, developed by Renewable Energy Systems, and since acquired by Foresight Group; A 3MW battery which is part of the Gateshead Energy Centre, developed by Gateshead Borough Council.

Other renewables: County Durham, Northumberland and Sunderland are all in the top six UK Local Authority areas for solar PV sites. The region also produces a greater proportion of renewable electricity from landfill gas and anaerobic digestion than the UK average, including through advanced anaerobic digestion processes pioneered by Northumbrian Water at its Howden site. Overall Northumberland generates almost 40% the amount of its total electricity use from renewable sources. A number of companies are also exploring and developing specific large-scale low carbon energy innovations in the North East. These include the Catfoss-owned ‘Graphite Resources’ energy from waste facility in Gateshead, which is developing is processes to convert waste into compost like output (CLO), refuse derived fuel (RDF) and solid recovered fuel (SRF).