Introduction

This is one of the 16 market profiles produced as part of the Economic Market’s foresight study commissioned by the North East LEP. It provides an overview of the future growth prospects for the Data analytics market globally, a summary of the enterprise base serving the market in the North East and relevant regional assets, and an analysis of how the continued convergence of global trends will affect future market development.

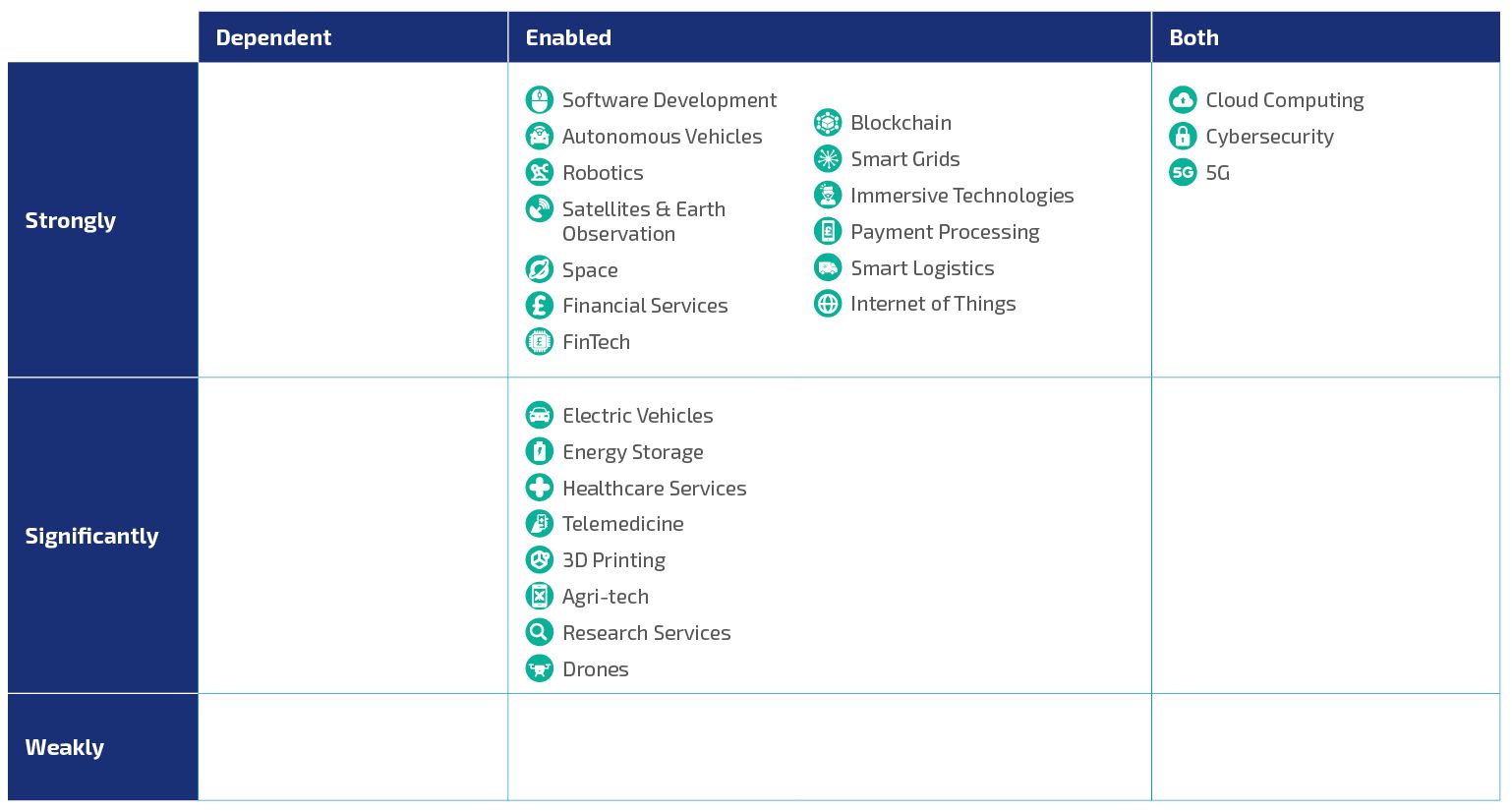

These markets were selected as those most likely to present opportunities for future regional growth in the North East LEP. This was done based on a trends analysis conducted by Frost and Sullivan, which identified 37 high impact trends driving continued change and growth in these markets globally. A shortlist of markets from this trends analysis was then cross-referenced against the current North East position by Cambridge Econometrics. This analysis identified the most significant opportunities for the North East LEP.

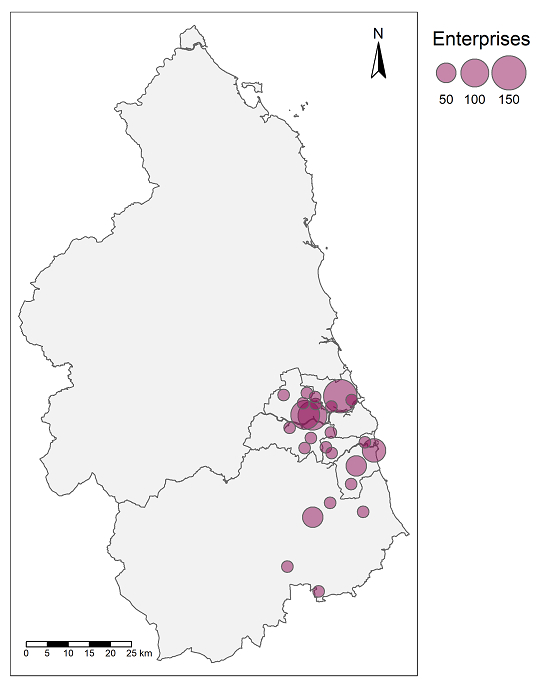

Each of these profiles also uses findings from the Data City platform to quantify the number of firms serving the Data analytics market in the North East. This platform links companies house data to companies’ websites and uses the website text and machine learning to classify firms into Real Time Industrial Classification Codes, which can allow analysis of markets often too emergent to be precisely measured in SIC codes. The data from this platform has been triangulated against ONS data to consider a variety of perspectives on the market.

More detail about the methodology can be found here for the 16 market profiles