Levelling-up

One of the Government’s other flagship policy areas is the Levelling Up agenda. This agenda aims to ensure that everyone in the UK has the opportunity to flourish by ending the extensive geographic inequality between different local areas. The objective of Levelling Up policy is to increase productivity, employment, pay, and living standards by growing the private sector, especially in areas that are currently underperforming.

The Government’s ambitions were set out in the February 2022 Levelling Up White Paper, which outlines 12 Levelling Up missions intended to provide clarity and consistency on policy objectives across government, with measurable outcomes by 2030. These missions cover a wide range of areas, including living standards, innovation, skills, and pride in place. Alongside each of these missions the Government published a series of provisional metrics against which progress on each mission is to be monitored. These metrics, particularly the metrics for mission 1 (living standards) provide a framework for understanding how growth in the advanced manufacturing sector can contribute to the Levelling Up agenda.

Advanced manufacturing already makes a key contribution to many of these metrics within the North East, particularly productivity, employment, and regional exports. In terms of productivity, productivity per hour worked in Sunderland is £38 per hour, significantly above the £33 per hour average for England excluding London. This is largely due to the highly productive automotive cluster in Sunderland and further growth in the sector could help bring overall productivity per hour in the North East LEP closer to the England excluding London average. The sector is also already well positioned to grow due to its embrace of the transition to electric vehicles, with the global electric vehicle market alone predicted to grow at a CAGR 22.6% between 21-25.

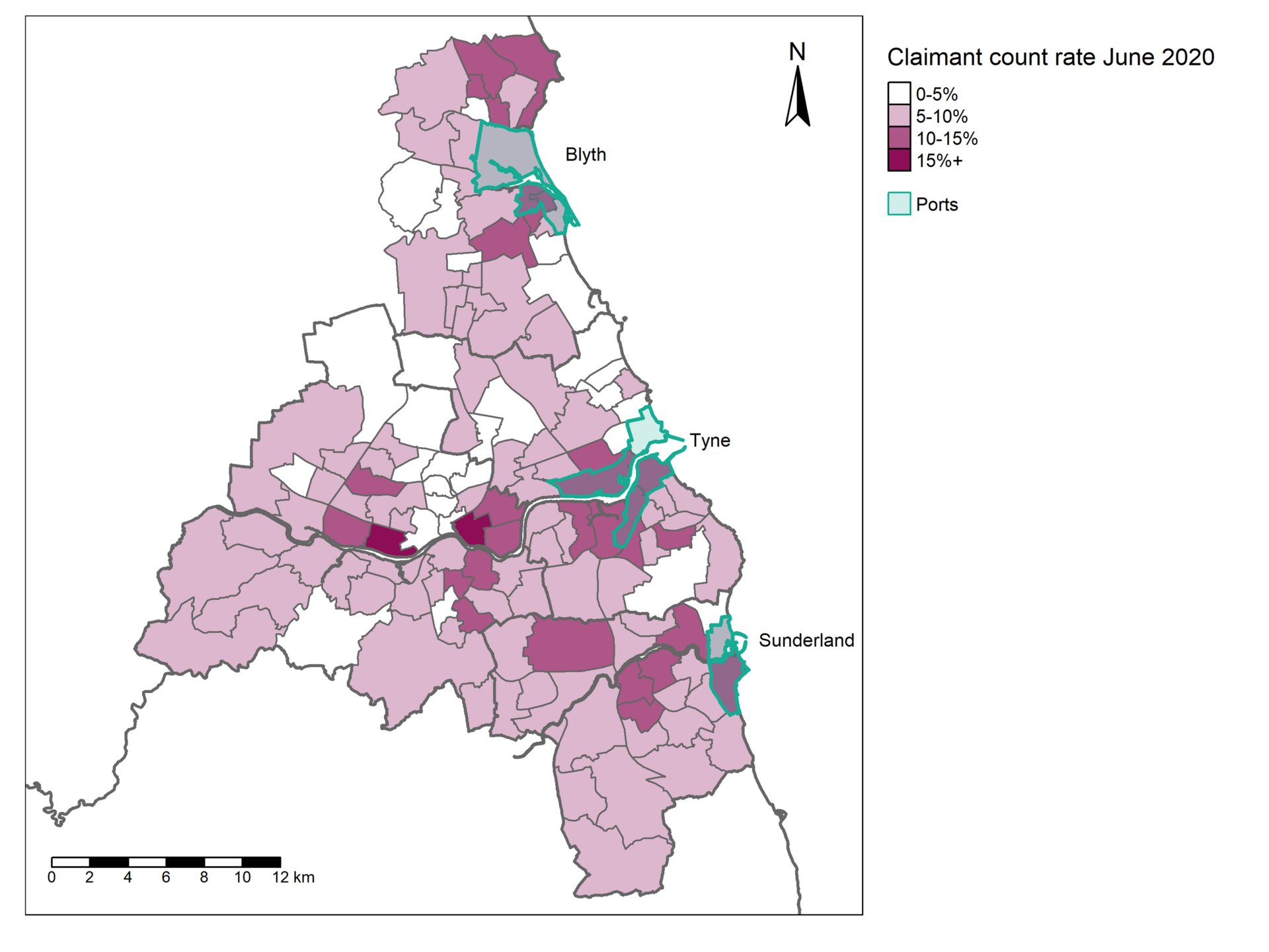

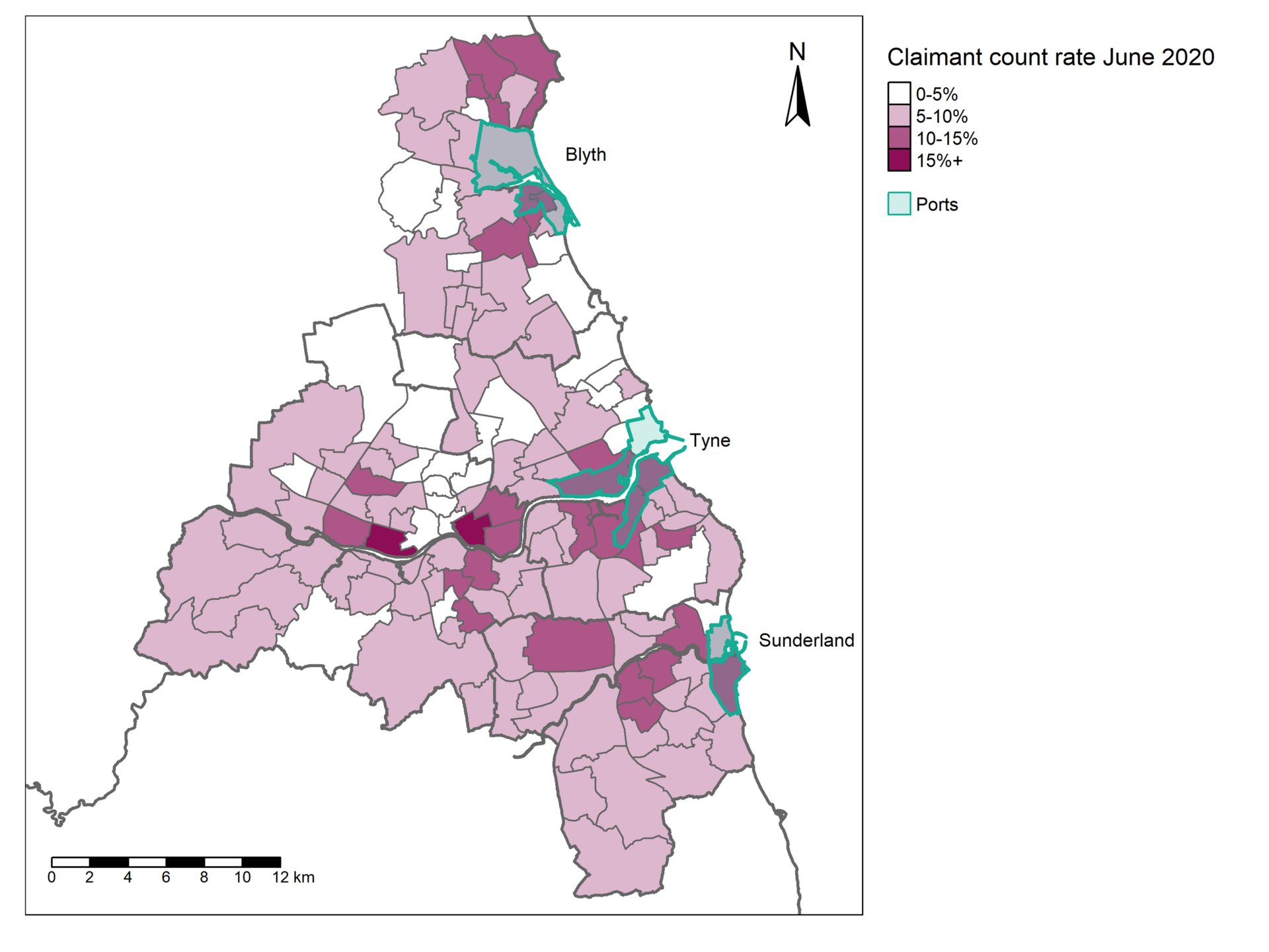

In addition to productivity, advanced manufacturing also makes a key contribution to regional employment, with 67,000 individuals in employment in the sector across the North East LEP in 2021. Not only this, but these employment opportunities are located in some of the more deprived areas of the North East LEP, and therefore contribute towards employment where the overall labour market is relatively weak. For example, the major employer in the sector, Nissan, is located in Sunderland, which of the 316 local authorities in England (excluding the Isles of Scilly) is the 23rd most income-deprived. Future growth in the sector, building on an existing skills base and ecosystem, can potentially further increase employment in relatively deprived parts of the country. The 21 sites across the North East Enterprise Zone, which enterprises in advanced manufacturing can benefit from, further help ensure that employment opportunities are distributed across the North East LEP area.

These employment opportunities are not limited to the sector itself, for as outlined in the North East Strategic Economic Plan growth in areas of strategic importance also contributes to employment in supporting sectors. In the case of manufacturing there are particular links to growth in employment in logistics through increased exports. Not only does this further increase the contribution of the sector towards regional employment, but growth in exports disproportionally impacts deprived and disadvantaged neighbourhoods, as the wards adjacent to the region’s ports are amongst the most disadvantaged in the region. As manufactured products tend to be exported through ports, these wards are more likely to benefit from growth in the sector.

In addition to its contribution to productivity and employment the sector is responsible for the majority of regional goods exports and a significant proportion of regional service exports. Machinery and transport equipment was responsible for 45% of North East exports in 2021, chemical and related products 24% and manufactured goods classified chiefly by material a further 16%. Road vehicles exports alone accounted for 21% of North East exports in the same year, while manufacturing service exports were the second largest industry grouping in 2019 accounting for 21% of the North East total. Growing the total value of regional exports can build on this already strong sectoral contribution.

Another key objective of Levelling Up policy is to improve pride in place, with Mission 9 focused on residents’ perception of their local area. Manufacturing has a long and distinguished history across the North East, which is reflected in positive public attitudes towards the sector and related industries. The growth and development of the sector can build on this heritage and contribute to regional pride.

In the Levelling Up White Paper, the government commits to supporting private sector partnerships and clusters to catalyse economic growth, job creation, and innovation. The North East Automotive Alliance (NEAA) and the North East of England Process Industries Cluster (NEPIC) are identified in the White Paper as examples of successful private sector initiatives.