The Domestic Retrofit Skills Challenge

In 2019, the UK government became the first major economy to legally commit to reducing carbon emissions. In October 2021, the Heat and Buildings Strategy set out the government's vision for a greener future and the pathway to transition to high efficiency, low carbon buildings.

The National Energy Policy on carbon emission abatement has been a driving factor shaping policy at a local level. The Heat and Buildings Strategy further emphasises the need to take account of individual, local and regional circumstances when making the transition to low carbon buildings. Local Authorities across the North East, and Yorkshire regions have demonstrating their strong commitment to this agenda by declaring climate emergencies.

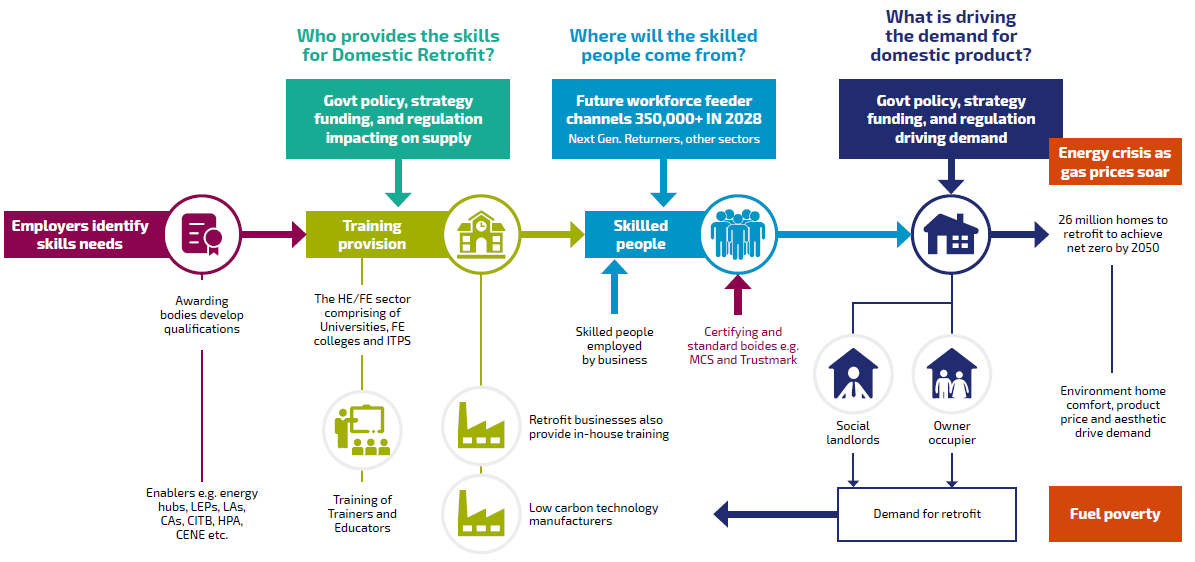

The scale of the challenge is vast. There are 24 million homes that require domestic retrofit. To achieve the 2050 targets, the UK must decarbonise the heating market at a rate of 20,000 homes per week by 2025. The current rate is 20,000 homes per year. The UK has one of the worst energy efficiency ratings in Europe with an older housing stock that is insufficiently insulated.

There are significant social and economic opportunities too that could be gained.

This challenge, if met, presents a significant economic and social opportunity for UK regions, potentially generating business growth and innovation and creating 240,000 skilled green jobs by 2035. The transition to low carbon, energy efficient homes has the potential of significantly reducing fuel poverty and thereby health inequalities.

The development of skills required to deliver net zero by 2050 remains the biggest problem to solve in terms of scale, pace, and quality. Business-As-Usual models will not work.